Stamp Duty

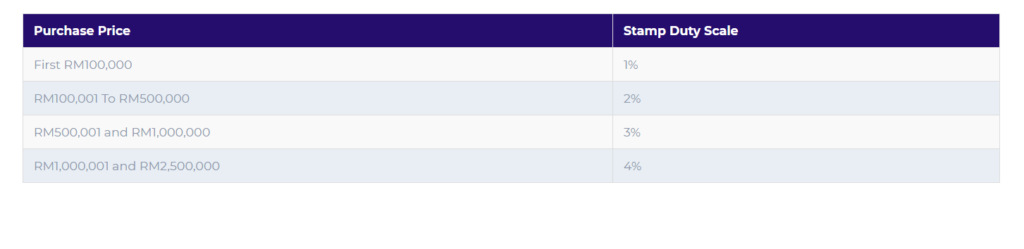

Stamp Duty – Sale & Purchase/ Transfer (MOT)

Stamp Duty – Loan

Loan amount x 0.5%

What Is Stamp Duty?

Stamp duty is a tax on legal documents such as a sale, transfer, home loan, or loan agreement. In situations where these legal documents are required, a stamp duty will apply.

Stamp duty can be complicated, but never fear, we’re here to help you understand it better!

First off, you need to know that it’s divided into two categories:

- Fixed Duties are charged at a set price, and include stamps for individual policies or copies.

- Ad Valorem Duties are variable costs based on the value of a transaction that legal documents represent. These include taxes such as those based on the value of a property transfer or loan agreement.

Stamp Duty Exemption For First-Time Buyers

Announced changes to stamp duty in Malaysia in 2018 mean that first-time buyers are now exempt from certain stamp duty charges.

This exemption was confirmed in the recent Budget 2019 put forward by the Malaysian Government. Yay!

First-time buyers purchasing a property priced up to RM300,000 will be exempted from stamp duty on any instrument of Transfer, as well as on any loan agreement, executed between 1 January 2019 and 31 December 2020.

Full exemption applies for first-time homebuyers on the instrument of transfer agreement for properties priced between RM300,000 and RM1 million from 1 January 2019 through to 30 June 2019.

That means no stamp duty will be owed on any loan agreement documents up to a value of RM300,000, and no stamp duty owed on any property transfer agreement up to RM1 million.

Changes To Stamp Duty In 2019

The stamping fee for a contract agreement in Malaysia is set to be impacted by a number of upcoming changes to the nation’s property market.

The National Home Ownership Campaign 2019 (HOC 2019) has introduced new incentives to support the property market.

A waiver of stamp duties will apply on qualifying properties within the scheme until 31 December 2019.

This means no stamp duties will be charged on instruments of transfer of purchase up to RM1 million, and for loan agreements up to RM2.5 million.

Stamp duty changes are also set to be implemented to the highest band of stamp duty this year. As of 1 July 2019, the stamp duty on instruments of transfer for properties exceeding RM1 million is to be raised from 3% to 4%.

We’re committed to helping homebuyers make clearer, easier choices when it comes to finding their next home.

We hope this simple guide has helped build your understanding of how stamp duty applies in Malaysia!

Other tools or reference which may be relevant to you.

- Home Loan Eligibility (how much loan you can borrow)

- Home Loan Calculator (how much monthly installment)

- Rental Yield Calculator

- Real Property Gain Tax

- Legal Fees