Residential Title vs Commercial Title

A basic question on the minds of young and first-time property investors is – should we buy residential or commercial? While both options come with boons and negatives – it’s not always easy to decide which is best for the individual buyer.

To help you get on the right path toward making a sound decision, we’ve simplified the pertinent points and differences between residential and commercial properties:

1. Title Types

The title generally states the purpose of the property as well as the restrictions and responsibilities by which owners and tenants will need to adhere.

Residential: In its most simplified terms – residential properties are for living or staying – you may reside here and use it as a home address. Under this title, you have more freedom to run your air conditioners all day long if you like or have parties. You may not however, (unless with special permissions) run a business from this address.

Commercial: Conversely, commercial properties are to be purposed for conducting business or related activities only. But of course, certain condos come under a commercial land title and some properties that can be lived in have a mixed title, making the distinctions less obvious.

2. Utilities, Taxes and Fees

Each property type is charged a different rate for utility services as well as property taxes (quit rent and assessment tax) and various fees.

Residential: Utility rates for one are definitely lower than what’s levied for commercial properties. For example, residential homes enjoy a lower TNB electricity tariff of RM0.218 per kWh whereas commercial properties pay almost double at RM0.435 per kWh for the first 200kWh.

However commercial title under HDA (Residential purpose) like Serviced Apartment is able to convert the electricity tariff back to residential rate. Water utility is unable to convert.

Commercial: On average, utility tariffs across the board for commercial properties tend be higher than residential rates and in terms of assessment, costs 2.5 times more.

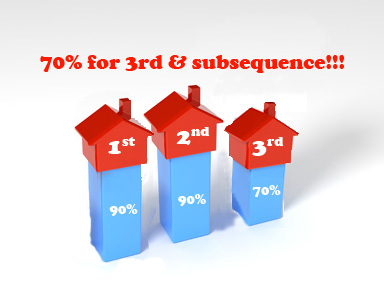

3. Margin of Financing

Buying a property often requires a loan, but the margin of financing for each type of purchase will differ.

Residential: Margins can stretch to 90%, where even zero-down, 100% loans are possible through various government schemes.

1st & 2nd residential properties – 90% of financing

3rd residential properties – 70% financing

Commercial: Property loans are generally provided with financing margins of 80% to 85% the purchase price (on average) and at slightly higher interest rates.

There isn’t a mandated restriction on the margin as there is with residential loans.

4. Rental Yields

It’s not easy to say which yields more because potential profits rely on more than just property title distinctions. You would have to first factor in the

- location,

- property construct style,

- amenities,

- economic conditions

- building quality

Residential: While these property types may spell a lower return to comparable commercial properties within the same locale, the costs to owning a residential property are lower. Here the probability of ownership is more attainable, though with lower potential profits.

Commercial: Commercial properties do return a higher yield and typically picks up in market price more quickly than (landed) residential properties do. Still, the capital and overall costs to purchase a highly-sought commercial property are characteristically higher than a residential property.

5. Rental Stability

Residential: Properties are easier to rent out but occupancy periods may be shorter, often lasting one to three years. Still, residential homes are starting to benefit from the possibility of lucrative short-term rentals and vacation stays. However, the property will need to be maintained and furnished thereby incurring some costs in addition to tenants requiring more active management.

Commercial: These properties may have an edge here since business tenants tend to stay longer, possibly from two to ten years, especially if modifications have been made to the property. This would limit the costs to rent (e.g. agent fees, advertising, etc.) however; vacancy periods are longer as well. Thus, buyers will have to cover loan instalments out-of-pocket until a suitable tenant is found.

6. Tenant Accountability

Residential: It can be tricky (and costly) to legally evict tenants from residential properties. Note that squatting is a serious concern, especially for homes purchased through auctions. Moreover, since the home will be “lived-in”, expect significant wear and tear – usually borne by the owner.

Commercial: Tenants are often businesses and this could be a positive for owners. Why? Because there is better legal recourse for owners in case of rental defaults, etc. In addition, a commercial property is often well-maintained as business tenants typically need to uphold a positive professional image and workplace environment.

7. Insurance

Whether commercial or residential, property purchases are often financed by a bank loan that typically makes insurance necessary to purchase. A Mortgage Reducing Term Assurance is purchased to cover loans in case of a borrower’s (extends to SME and business financing) inability to make payments due to death or disability. In addition, a fire insurance policy could be insisted on as well to protect the property, so it may remain a viable asset if repossession is necessary.

Residential: There is not a compulsory insurance requirement on landed homes if you buy with cash. If you plan to rent it out however, you’ll notice that most tenancy agreements come with a fire insurance clause that often extends to cover other acts of nature such as floods and lightning damage. Owners of residential properties with strata titles do pay for their portion of fire insurance policies since it is a compulsory purchase by the MC.

Commercial: These properties are required to have fire insurance and sprinkler systems installed to provide cover and protection against potential mishaps.

Conclusion

The best decision when investing (or buying for personal use) is to go with the property that you can afford.

Commercial properties may on average produce a higher rental yield, but if you can’t afford it, you could start small with an affordable residential property.

If you need personal consultation, do can consult :-

Call /Text / Whatsapp @ Ryan +6012-4049931