Should I Buy Now or Wait ?

If you are torn between the idea of purchasing a home in 2020 or to continue renting while you wait a bit longer to get on the property ladder, then this article is for you.

You have heard this a million times before – buying your own house or residential property is one of your biggest life milestones. The idea of investing a huge sum into such an asset seems daunting, however, as the economy is not so rosy at the moment.

Factor in other external variables such as fluctuations in the property market and new government rulings such as the increase in real property gains tax (RPGT), you have a multitude of factors to consider.

But then again, just like most Malaysian millennials out there, you are probably tired of having a sizeable chunk of your salary go towards monthly rental payments.

However, the answer to the now VS later debate isn’t so cut and dried. Here we answer 8 questions you might have and by the end of this guide, you should have a clearer picture of which route to take:

What are the median prices of homes across Malaysia?

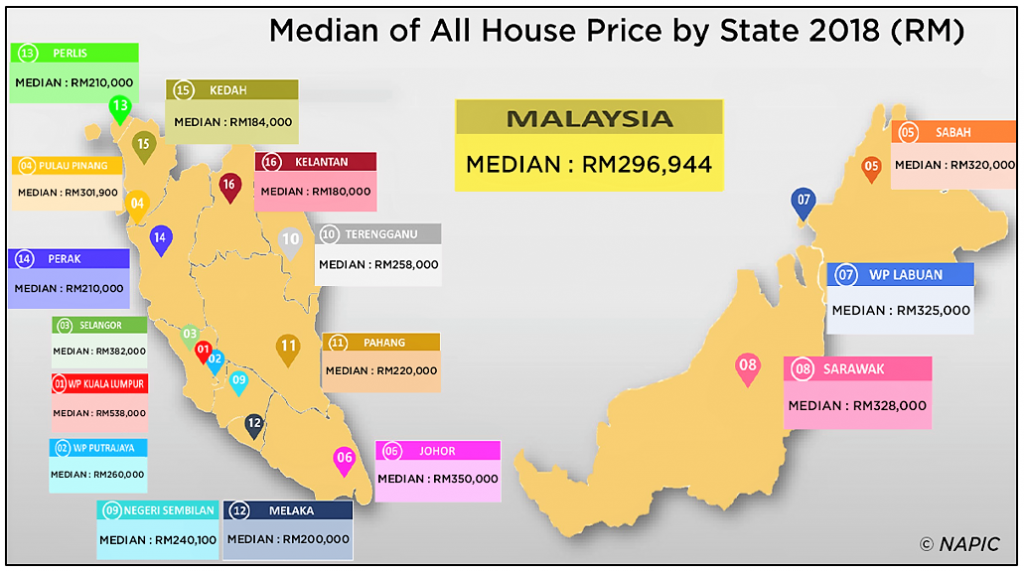

Your buying decision obviously depends on the price of the property and whether you have enough money to buy a home in your preferred location. Before we dive into the critical aspects of homeownership, let’s take a look at the latest median prices for residential properties across Malaysia.

.

According to the National Property Information Centre (NAPIC), the 2018 median price of a house in Malaysia was RM 296,944. However, this price varies between states, with Kuala Lumpur topping the list as the most expensive location to own a home at RM538,000.

Median prices depends on actual transactions and is not based on advertised selling price. This is why property prices would usually inch upwards even if transaction activity may not seem robust.

Also, transactions here refer to the transfer of both primary and sub-sale homes within the review period at all stages of construction – completed, under construction and planned.

.

Will home prices go down anytime soon?

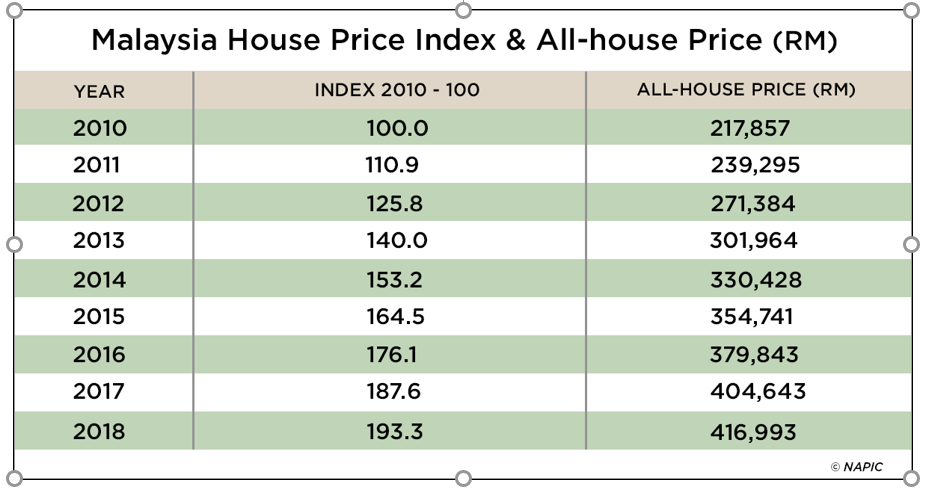

Well, we hate to be a party pooper, but historical data has shown that it is unlikely for residential real estate prices to fall in the near future. Regardless of economic slowdowns, property market fluctuations and changes in government policy, housing prices have been on an upward trend since 2010.

The 2018 Malaysian House Price Index (MHPI) stood at 193.3 points, up by 3.1% against 2017 MHPI of 187.6 points. 2016 MHPI was at 176.1, a 6.5% increase from the 2015 MHPI of 164.5….Well, you get the idea.

Admittedly the Y-O-Y growth in housing prices has tapered off quite a bit, thanks to preventative measures by Bank Negara Malaysia (BNM) circa 2014 to mitigate property speculation.

Even then, property prices have continued to climb each year. So, if you are waiting in anticipation of the next recession cycle for property prices to decline, then it is probably better to buy now rather than waiting for the long term.

.

How much is your debt to income ratio?

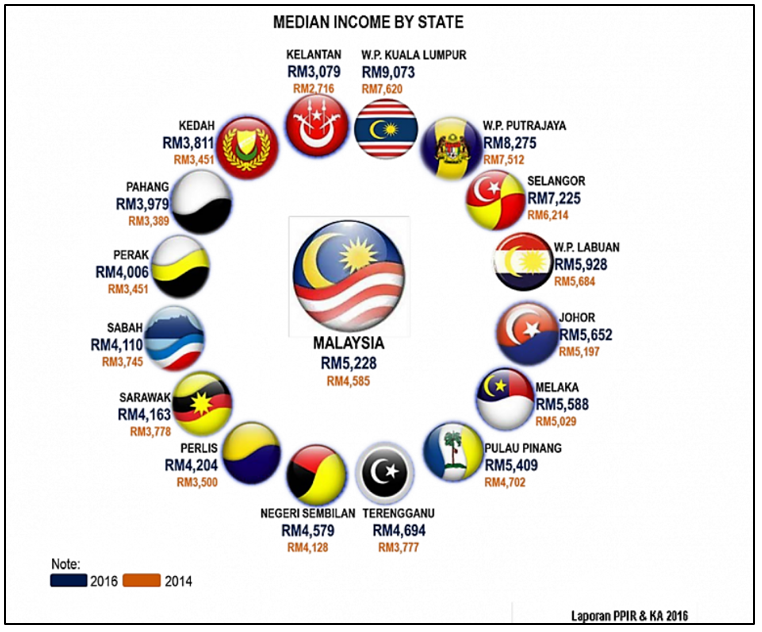

As per the latest figures from the Department of Statistics Malaysia (DOSM), the median household income of a Malaysian family is RM 5,228 per month, but this figure fluctuates quite a bit from state to state.

For instance, the median income of a household in Kuala Lumpur is around RM9,073 whereas in a less urbanised state like Kelantan, a similar household may only be bringing home roughly RM3,079 monthly.

Household income is an important component in calculating your Debt-to-Income (DSR) ratio, which is the ratio of a person’s total debt to their household income. Your DSR helps you gauge whether you will be able to secure a home loan in the first place.

DSR = Debt/Net Income X 100

This is because the DSR is one of the main qualifying factors for a home loan application. A good DSR proves to the banks that you can afford to pay the monthly instalments throughout the loan tenure – Generally, banks will not accept a DSR that exceeds 70%. We can also help you calculate your home loan eligiblity.

If you determine that your DSR is within a healthy range and you have enough savings, you can then proceed to the next step.

However, if you are already struggling with your financial obligations, it is best to put your homeownership dreams on the back burner and work on improving your finances first. Do take note that you require a healthy credit score too, which is another matrix banks use to subjectively evaluate the credibility of your home financing application. The credit score ranges from 300 to 850; the higher your credit score, the lower your credit risk.

What are the lending rates if you buy now VS later?

If you’ve been sticking to the “wait and see” sentiment this past year or so, then now will be the perfect time to buy a home since BNM has lowered the Overnight Policy Rate (OPR) from 2.75% to 2.5% effective from 3 March 2020.

OPR is the rate a borrower bank has to pay to the lending bank for the funds borrowed. A lower OPR has a declining impact on Base Lending Rate (BLR), Base Rate (BR) and the effective lending rate (ELR) of your home loan. Thus, home buyers now have a better chance of getting a loan at a lower interest rate.

Should you decide to leverage on this opportunity, you might want to shop around for the best rates offered by banks that suit your risk profile. Do take note that a lower BR offered by one bank does not necessarily mean that it has the lowest ELR.

How will your home loan payments look like if you buy now VS later?

It is safe to anticipate that median property prices will only increase with time. But, how will this affect your mortgage payments?

Let’s say, you have decided to buy a 3+1-bedroom condominium unit in Bandar Sungai Long. To commit, normally you will have to pay an upfront 10% down payment as well as entry fees (legal fees, stamp duty and valuation fees, insurance and monthly mortgage payments), for new project you just need booking fees RM1,000.

We will be comparing the price differences for buying the house now and 3 years later, where the monthly instalment and entry fee calculations were made using our home loan calculator, utilising the following terms: a 35-year loan tenure at 4% interest and 90% loan

Buy a home now

| Cost of House: RM 435,000 Total Home Loan (90%): RM 391,500 |

10% Deposit: RM 43,500

Entry Fees: RM 17,263

Insurance: RM 11,745 (3% of total mortgage)

Total Initial Housing Cost = RM 72,508

Monthly Instalment Payment: RM 1,852

Total Instalment Payment over 35 years = RM 778,840

TOTAL COST: RM 72,508 + RM 778,840 = RM 850,348

Buy a home in 3 years time (Assuming a Y-O-Y 3.5% growth in MHPI)

| Cost of House: *RM 482,292 Total Home Loan (90%): RM 434,063 |

10% Deposit: RM 48,229

Entry Fees: RM 19,145

Insurance: RM 13,021 (3% of total mortgage)

Total Initial Housing Cost = RM 80,395

Monthly Instalment Payment: RM 2,054

Total Instalment Payment over 35 years = RM 862,680

TOTAL HOUSING COST: RM 80,395 + RM 862,680 = RM 943,075

| Cost savings if you buy now VS in 2022: RM 943,075 – 850,348 = RM92,727 |

*Cost of house in 2022 was calculated using the following formula:

Future Value = Future Growth [(1+annual rate)^years] X Current Value

= [(1+0.035)^3 years] X RM 435,000

= RM 482,292

As you can see, your housing cost, payment and even your entry fees will appreciate over time. Assuming the variables above, you will be spending an additional RM92,272 should you decide to postpone your home purchase to 2022. You could play around with the formula above to estimate how much a property would cost X years down the road.

Couples or double-income families, in particular, would want to take a hard look at their current home rental expenditure. If you and your spouse (or partner) are already paying upwards of RM1,500 per month for your rental unit, then it would probably make sense to purchase your own piece of real estate now. You could be using the same amount of cash to start paying off for a property of your own that costs RM400,000 – RM450,000 today.

.

Are there any government incentives to buy now VS later?

There are a number of schemes aspiring homebuyers could leverage on:

- BNM has set up a RM 1 billion fund with low financing rate of 5.35% to help first-time homebuyers to buy houses ranging up to RM 150,000. You are eligible for this loan if your monthly income is RM 2,300 or below.

- Youth Housing Scheme – This scheme was the result of the collaboration of 3 parties: Bank Simpanan Nasional (BSN), Employees Provident Fund (EPF) and National Mortgage Corporation of Malaysia (CAGAMAS). If you are single or newly married, you can use this scheme to take a 100% loan on your first home at prices ranging between RM 100,000 – RM 500,000. Under Budget 2020, it was announced that the Youth Housing Scheme will be extended until December 2021. Also, there will be a RM200 monthly instalment assistance for the first two years limited to 10,000 home units only.

- MyHome housing scheme – This will help pay 10% of your purchase price up to a maximum of RM 30,000 as a deposit to get you started on your first home. It is open to households earning up to RM10,000 per month.

- Residensi Wilayah (RUMAWIP) – This scheme is specially designed for first-time buyers who fall under the low-to-middle income groups. This program offers a variety of properties in the Federal Territories such as Kuala Lumpur, Putrajaya and Labuan at affordable prices. Checkout this Bangsar South Rumawip.

.

Do you have enough cash for the closing costs?

Buying a house requires a number of payments at different phases. First, you have to fork out 10% of your purchase price as a deposit to lock in the property. Then, you have to pay the monthly loan instalments for the next 30 or 35 years.

Apart from that, there are also a number of fees you need to cover, known as the closing costs. These amount to 2-5% of your real estate value and comprise expenses such as legal fees, agents’ fees, valuation fees and stamp duties. Check out the latest cost of buying property in 2020.

Besides that, first time home buyers who are keen on capital growth will have to keep property tax in mind. Since their first purchase is usually a starter home and they will have plans of upgrading after 5 years or so, these purchasers will want to secure a tidy profit when selling off their home. Do note that property sellers are now required to pay a minimum 5% Real Property Gains Tax (RPGT) when selling off their home. The consequence of late property tax payment (after 60 days) is 10% of the RPGT payable amount.

Buying a home involves a lot of research and personal assessments from your end, but this guide could help you navigate the process smoothly from the get-go.

.

If you need personal consultation, do can consult :-

Call /Text / Whatsapp @ Ryan +6012-4049931